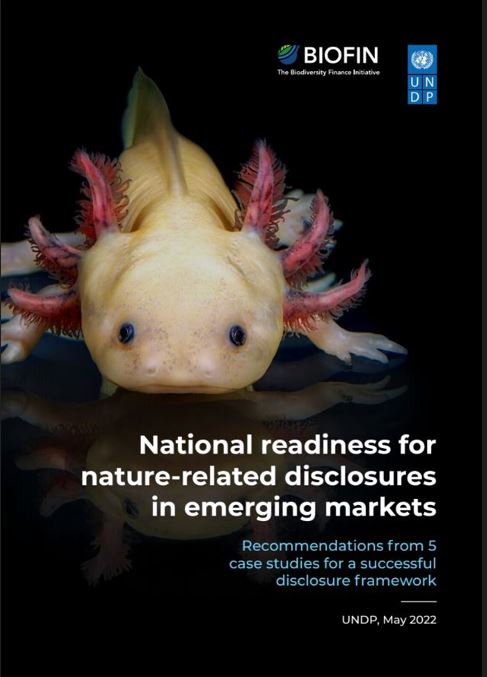

This paper introduces a new measure of a firm’s negative impact on biodiversity, the corporate biodiversity footprint, and studies whether it is priced in an international sample of stocks. On average, the corporate biodiversity footprint does not explain the cross-section of returns between 2019 and 2022. However, a biodiversity footprint premium (higher returns for firms with larger footprints) began emerging in October 2021 after the Kunming Declaration, which capped the first part of the UN Biodiversity Conference (COP15). Consistent with this finding, stocks with large footprints lost value in the days after the Kunming Declaration. The launch of the Taskforce for Nature-related Financial Disclosures (TNFD) in June 2021 had a similar effect. These results indicate that investors have started to require a risk premium upon the prospect of, and uncertainty about, future regulation or litigation to preserve biodiversity.